Drawings Debit Or Credit

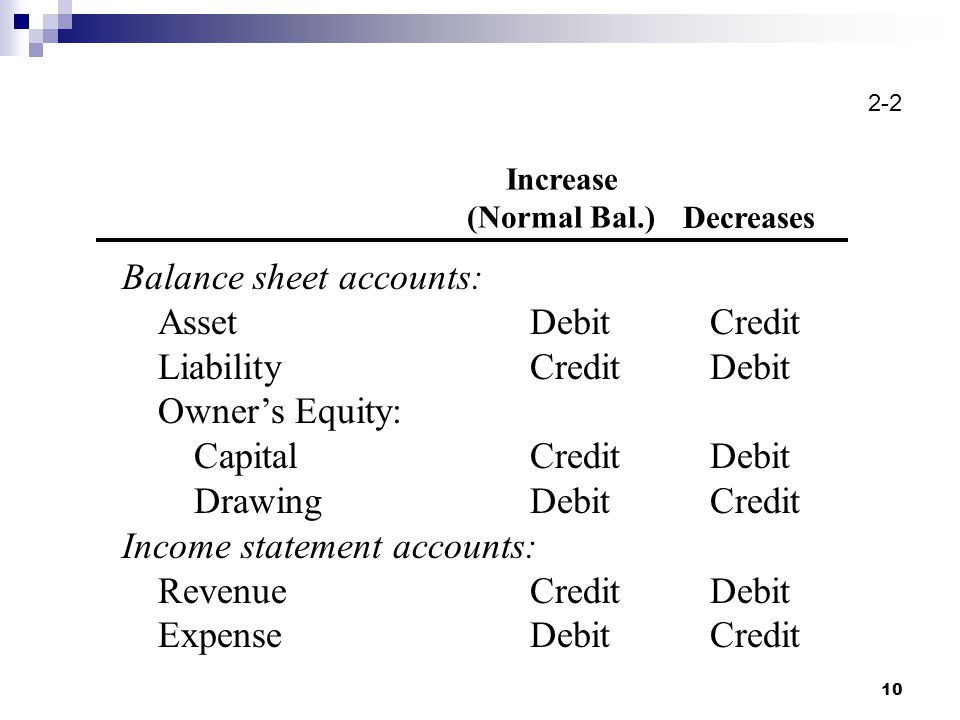

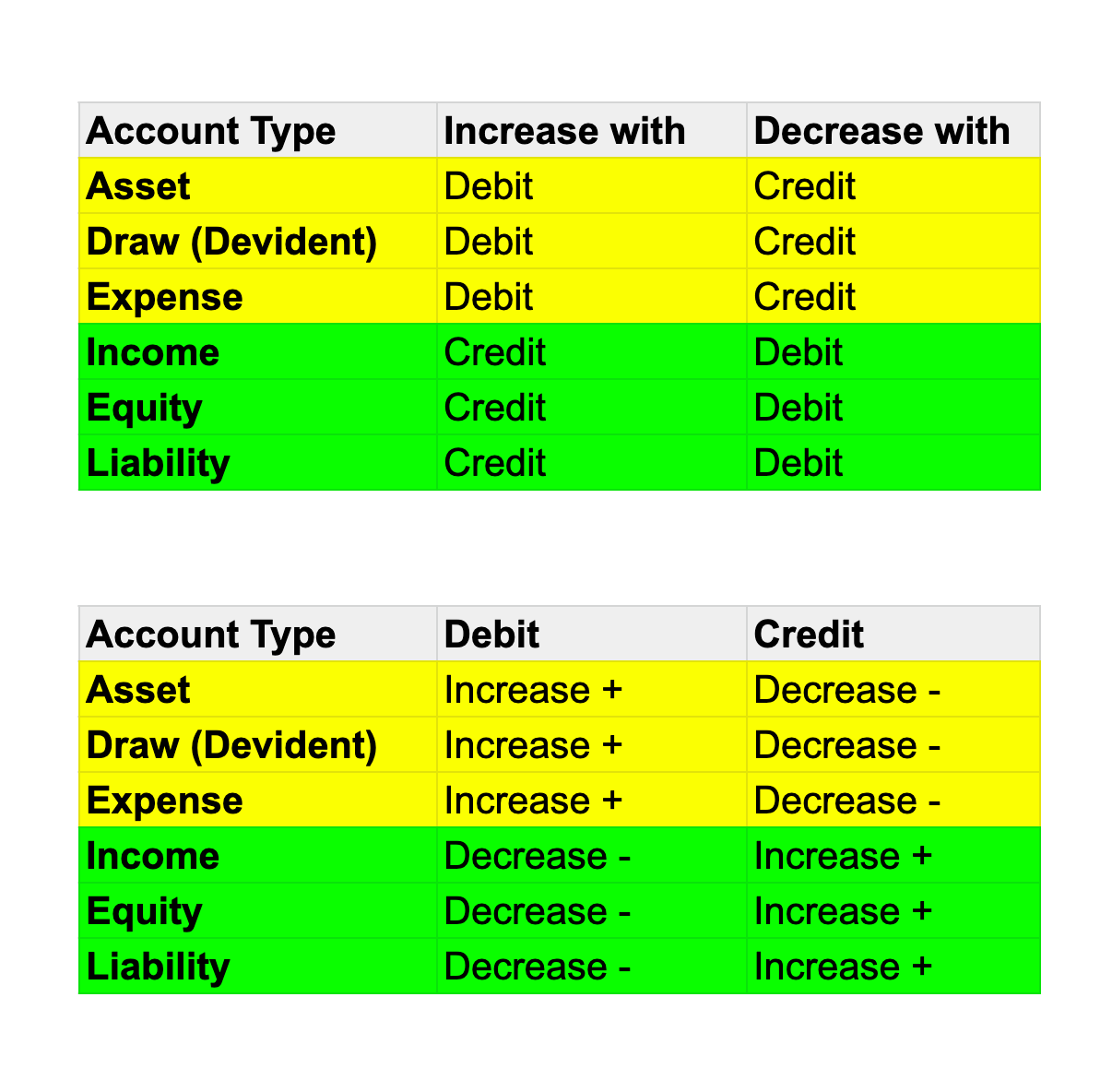

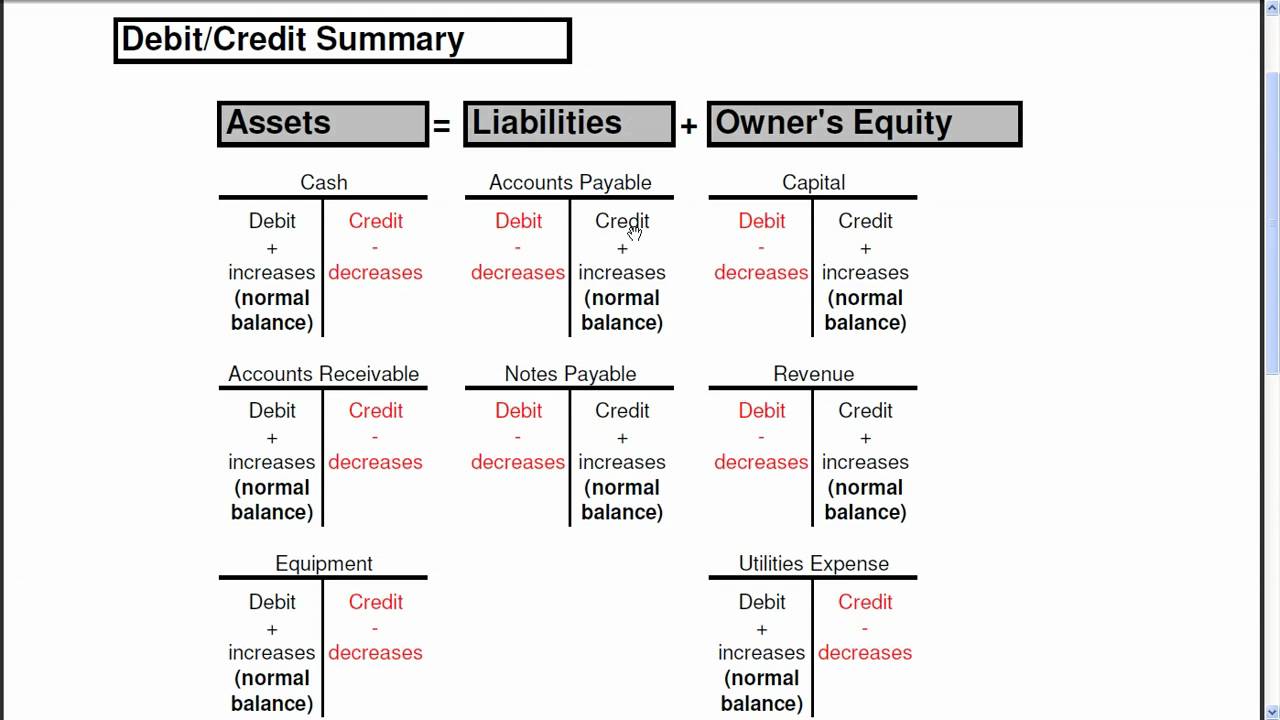

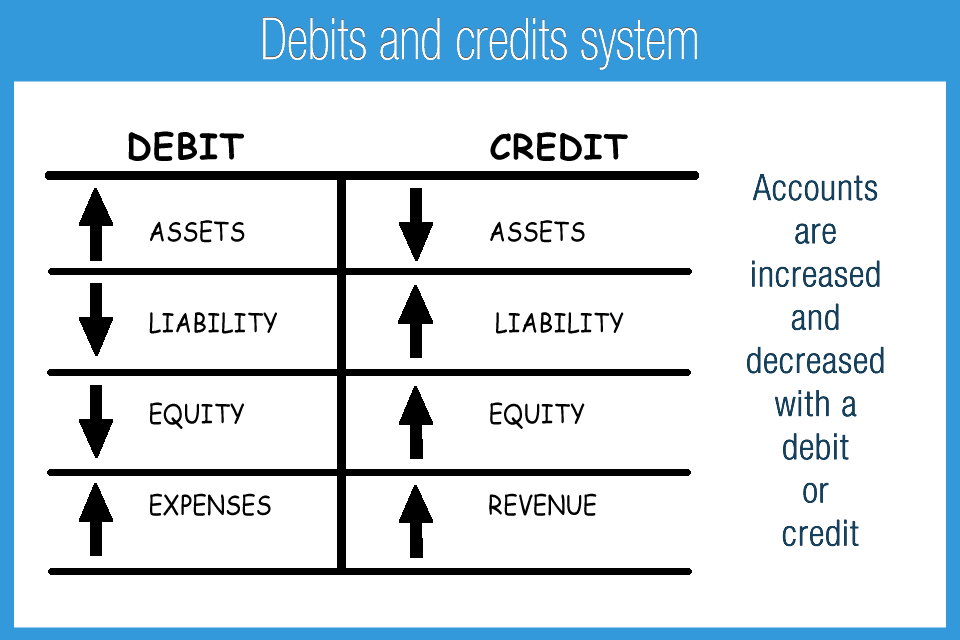

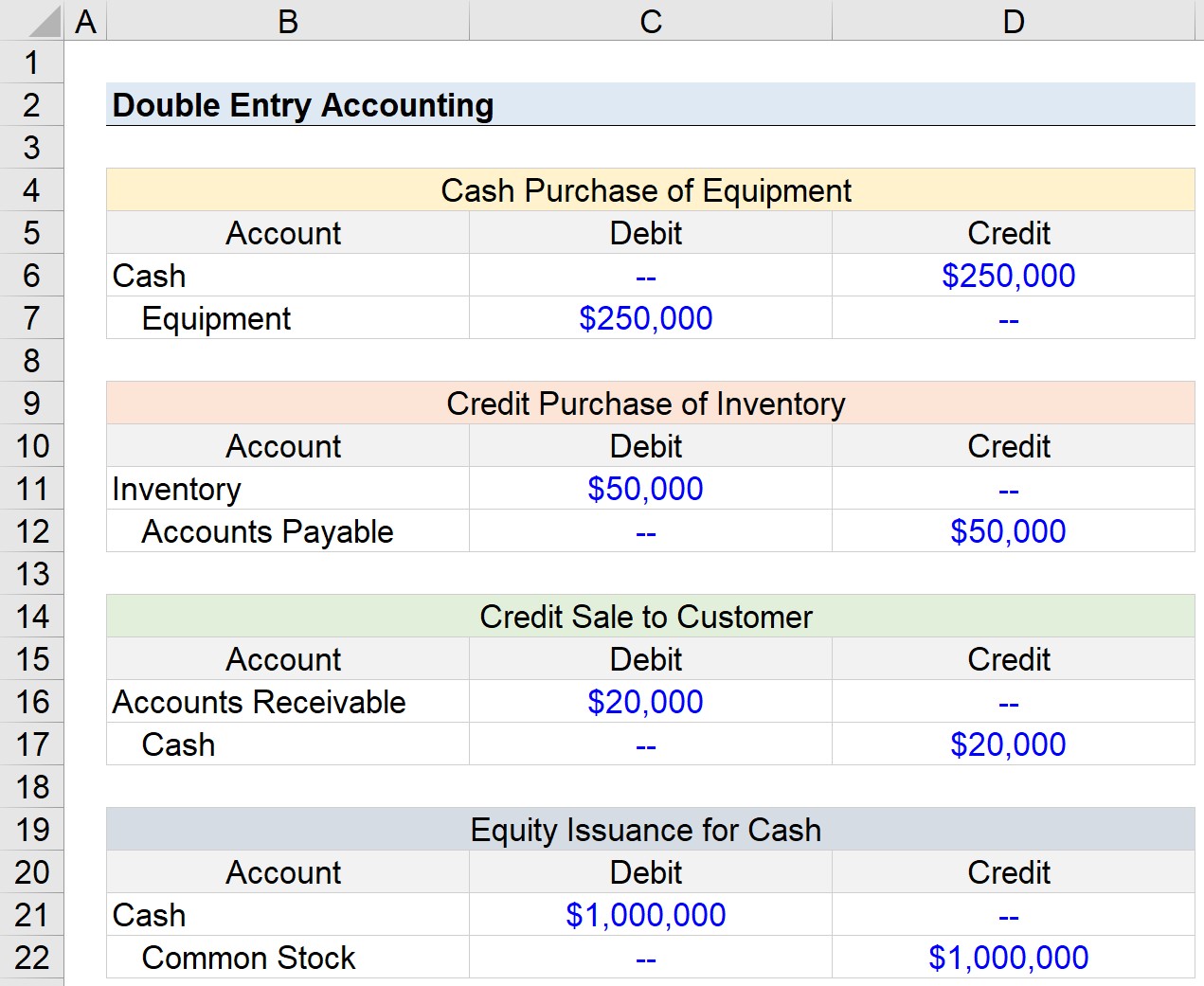

Drawings Debit Or Credit - Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. In this article, we wanted to go into some more detail, provide a complete article on what drawings are, accounting for them, and show some examples of. We keep the capital account as one account for investments in the business by the owner, and drawings as a separate account to show only divestments or withdrawals by the owner. Usually, owners have the right to do so due to their ownership of the entity’s balance. Rules of debit and credit. One of the ledgers must have a debit entry and another ledger must have a credit entry for the same transaction. Web the meaning of drawing in accounts is the record kept by a business owner or accountant that shows how much money has been withdrawn by business owners. Debit means left and credit means right. The withdrawal of cash by the owner for personal use is recorded on a temporary drawings account and reduces the owners equity. Funds are drawn directly from a linked checking account. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Debit card transactions are typically faster and more secure than paying by check. Web drawings accounting bookkeeping entries explained. Web an owner’s draw, also called a draw, is when. Web effect of drawings on the financial statements. An entry that debits the drawing account will have an equal and opposite credit to the cash account. Web a journal entry for the drawings account comprises a debit to the drawings account and a credit to the cash account. Web checking accounts and debit cards work together but can serve different. An increase to an account on the left side of the equation (assets) is shown by an entry on the left side of the account (debit). In this article, we wanted to go into some more detail, provide a complete article on what drawings are, accounting for them, and show some examples of. The drawing account’s debit balance is contrary. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. The owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn and by the decrease in owner’s equity. One of the ledgers must have a debit entry and another ledger must have a. Web we always debit the drawings account. Web drawings are money or assets that are withdrawn from a company by its owners for personal use and must be recorded as a reduction of assets and owner's equity. Web should i use debit or credit? Web we have written a few articles on owners drawings, in particular dealing with interest charges. Web checking accounts and debit cards work together but can serve different purposes. The withdrawal of cash by the owner for personal use is recorded on a temporary drawings account and reduces the owners equity. Capital is debit or credit? Debit is abbreviated as dr. and credit, cr.. Do not associate any of them with plus or minus yet. So, if your business were to take out a $5,000 small business loan, the cash you receive from that loan would be recorded as a debit in your cash, or assets, account. Web the rules of debits and credits. Web effect of drawings on the financial statements. Debits and credits in accounting. The owner’s drawings will affect the company’s balance. Web we always debit the drawings account. Debit is abbreviated as dr. and credit, cr.. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Debit means left and credit means right. Web a drawing account is a contra account to the owner’s equity. Usually, owners have the right to do so due to their ownership of the entity’s balance. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Web effect of drawings on the financial statements. What is the journal entry for purchased goods on credit? Do not associate any. So, if your business were to take out a $5,000 small business loan, the cash you receive from that loan would be recorded as a debit in your cash, or assets, account. The owner’s drawings of cash will also affect the financing activities section of the statement of cash flows. Web an owner’s draw is a financial mechanism through which. Web drawings accounting bookkeeping entries explained. Web owner withdrawal also referred to as drawings, is when an entity’s owner withdraws assets from it. A drawing account serves as a contra account to the equity of the business owner. Web owner’s drawing is a temporary contra equity account with a debit balance that reduces the normal credit balance of an owner's equity capital account in a business organized as a sole proprietorship or partnership by recording the current year’s withdrawals of asses by its owners for personal use. Debit means left and credit means right. Therefore, those accounts are decreased by a credit. The owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn and by the decrease in owner’s equity. Web the typical accounting entry for the drawings account is a debit to the drawing account and a credit to the cash account (or whatever asset is being withdrawn). The owner’s drawings of cash will also affect the financing activities section of the statement of cash flows. Web a drawing account is a ledger that documents the money and other assets that have been taken out of a company by its owner. What is the journal entry for purchased goods on credit? Rules of debit and credit. Drawing account balances are transferred to the owner's equity account as the funds are for personal use. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Debits and credits in accounting. Web the company can make the drawings journal entry by debiting the drawings account and crediting the cash account.

Drawings Debit or Credit? Financial

How to draw DEBIT CARD YouTube

Drawing Credit at Explore collection of Drawing Credit

Drawings Accounting Double Entry Bookkeeping

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

Cash Drawings Journal Entry Drawing with Crayons

What are Debits and Credits in Accounting

Debit and Credit in Accounting Explained StephanyqoJames

What is Debit and Credit? Explanation, Difference, and Use in Accounting

Drawings Accounting Debit Credit Ppt Powerpoint Presentation Visual

What is Double Entry Bookkeeping? Debit vs. Credit System

Credit Accounting, It’s Important To Understand That They Actually Work Together.

We Keep The Capital Account As One Account For Investments In The Business By The Owner, And Drawings As A Separate Account To Show Only Divestments Or Withdrawals By The Owner.

The Withdrawal Of Cash By The Owner For Personal Use Is Recorded On A Temporary Drawings Account And Reduces The Owners Equity.

It Is Not An Expense Of The Business.

Related Post: