How Does A Commission Draw Work

How Does A Commission Draw Work - Your commission plan should be clear and simple. This way, your business doesn’t lose any money when paying the draws. Web commission employee labor laws are laws that cover the amount of commission that can be earned for employees earning such commissions. A sales commission draw may be defined as an advance or loan against commissions earned in future months, or it could simply be viewed as another term for “advance on commission” or “advance against future commissions”. As a flat amount for each sale (e.g. Web a draw against commission is a type of incentive compensation that functions as guaranteed pay that sellers receive with every paycheck. How does draw against commission work? A commission draw is an opportunity to borrow against future commissions. You get the money when you need it most and can pay for basic living expenses, such as bills and. Web here's the formula for a draw against commission pay structure: Web how does a draw against commission work? Employers sometimes use sales commissions as incentives to increase worker productivity. [adobe/studio science] learn the basics of strong, effective sales commission plans to attract top talent and drive business goals. For example, if you give an employee a draw of $2,000 per month, you expect the employee to earn at least $2,000. For example, say you earned a $25,000 draw and an additional $50,000 in commission. These laws also cover the minimum amount of additional pay that employees must receive, which can include certain bonus pay as well as overtime pay. Web a draw is an advance against future anticipated incentive compensation (commission) earnings. This amount is known as the draw. if. Sales commissions create the opportunity to gain significant income beyond a base salary. It usually comes out at the beginning of a pay or sales period in the form of a predetermined lump sum. The employer sets a fixed amount of draw for the employee. These laws also cover the minimum amount of additional pay that employees must receive, which. Web a draw against commission (or draw) is a sales compensation method that provides a sales representative with an advance payment from the company based on projected sales. Web how does a commission draw work? As a flat amount for each sale (e.g. Web draw against commission is a salary plan based completely on an employee’s earned commissions. This way,. Different people are motivated by different. As a percentage of sales made (e.g. You get a 10% commission on sales made so, when you make a sales worth $100, you’ve earned a $10 commission); At the end of the sales cycle, the employer deducts the amount of the advanced payment, or draw, from the total commission that the employee earned.. Web a draw is a commission payment made to the salesperson before the end of the month. You get a 10% commission on sales made so, when you make a sales worth $100, you’ve earned a $10 commission); A commission may be paid in addition to a salary or instead of a salary. For example, say you earned a $25,000. This form of payment is a slightly different tactic from one where an employee is. What is a commission draw? Web in terms of structure, a commission is money paid by an employer to an employee on a regular basis, in payment for services rendered on the job. At the end of the pay period or sales period, depending on. Web how does a sales draw work? Web commissions are typically calculated in one of two ways: This amount is known as the draw. if the employee sells more than this amount, it becomes their income, and anything else they make is commission. Web how does a commission draw work? At the end of the sales cycle, the employer deducts. It usually comes out at the beginning of a pay or sales period in the form of a predetermined lump sum. This amount is known as the draw. if the employee sells more than this amount, it becomes their income, and anything else they make is commission. For example, say you earned a $25,000 draw and an additional $50,000 in. The draw and the commission are taxed together as ordinary income. Web how does a commission draw work? For example, if you give an employee a draw of $2,000 per month, you expect the employee to earn at least $2,000 in commissions each month. If the salesperson’s commission exceeds the draw, they will earn a higher salary. Web by core. Web you are basically loaning employees money that you expect them to pay back by earning sales commissions. For example, say you earned a $25,000 draw and an additional $50,000 in commission. This form of payment is a slightly different tactic from one where an employee is. Web when a company provides a draw against commission pay, it gives the employee a specific amount of money at the start of their work. Web in terms of structure, a commission is money paid by an employer to an employee on a regular basis, in payment for services rendered on the job. The draw and the commission are taxed together as ordinary income. Formulas, examples, and best practices. Web draw against commission is a salary plan based completely on an employee’s earned commissions. An employee is advanced a set amount of money as a paycheck at the start of a pay period. Your commission plan should deliver results in real time. You get the money when you need it most and can pay for basic living expenses, such as bills and. Web commissions are typically calculated in one of two ways: This way, your business doesn’t lose any money when paying the draws. You get $10 for each sale so, then you sell 3 items, you’ve earned a commission of $30). Employers sometimes use sales commissions as incentives to increase worker productivity. A sales commission draw may be defined as an advance or loan against commissions earned in future months, or it could simply be viewed as another term for “advance on commission” or “advance against future commissions”.

How to draw a commission work 🙂, Timelapse video 💙 YouTube

How Does a Draw Work in Sales A Comprehensive Overview

Create A Sales Commission Plan Structure 2023 (With Examples)

How to draw commission work 🤔 New commission workHimanshu RRS YouTube

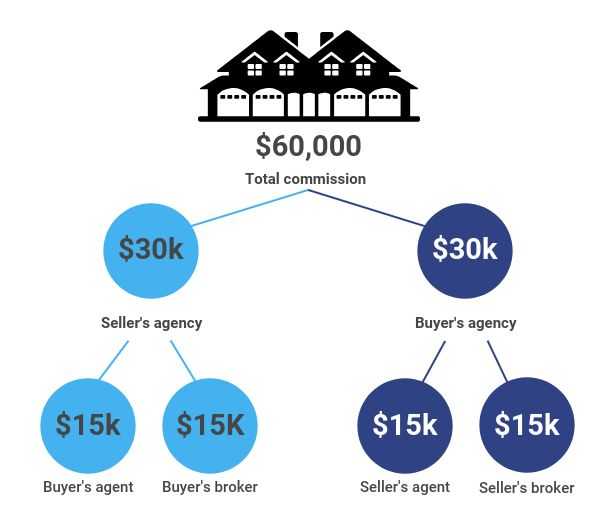

How Real Estate Commission Structure REALLY Works

The Blog

![6 Sales Commission Structures You Should Know [Free Calculator Inside]](https://www.salesmate.io/blog/wp-content/uploads/2021/12/Commission-draw.jpg)

6 Sales Commission Structures You Should Know [Free Calculator Inside]

How Much Commission Does a Realtor Make On a MillionDollar House?

Ultimate Commission Guide for Artists (+ Free resources)

Sales commission draw explained QuotaPath

At The End Of The Pay Period Or Sales Period, Depending On The Agreement, The Draw Is Deducted From The Employee’s Commission.

Web Here's The Formula For A Draw Against Commission Pay Structure:

This Amount Is Known As The Draw. If The Employee Sells More Than This Amount, It Becomes Their Income, And Anything Else They Make Is Commission.

Web Draw Against Commission Is A Type Of Commission Plan That Guarantees A Paycheck To Your Employees Each Pay Period Whether Or Not They Have Sales In That.

Related Post: