Owners Drawings

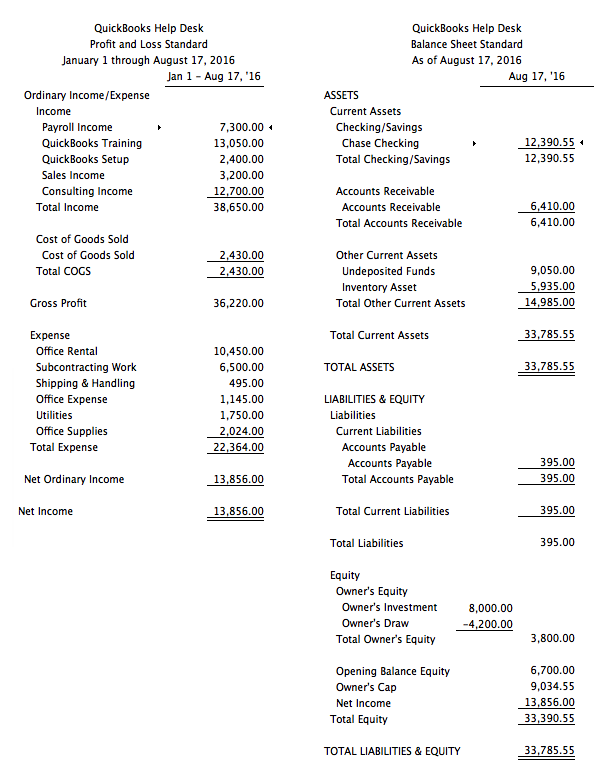

Owners Drawings - Web an owner’s draw refers to an owner taking funds out of the business for personal use. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. It might seem like raiding the company for. The owner's draw is essential for several reasons. In this article, we wanted to go into some more detail, provide a complete article on what drawings are, accounting for them, and. Web owner's drawings refer to the withdrawal of cash or other assets from a business by its owner for personal use. These draws can be in the form of cash or other assets, such as bonds. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web an owner's draw is money taken out of a business for personal use. Whatever funds are available after you pay your bills are yours for personal use or to put back into the. Web head coach mike tomlin, general manager omar khan and team owner art rooney ii spent a little more than an hour combined going over a. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. Patty could withdraw profits from her business or take out funds that she previously contributed to her company. Web an owner’s draw refers to an owner taking funds out of the business for personal use. Salary. Web an owner's draw is money taken out of a business for personal use. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. Web seize the grey is possible to compete in the $2 million, grade 1 preakness stakes on may 18 at pimlico race. Web an owner’s draw refers to an owner taking funds out of the business for personal use. Sat in his room thursday evening at the atlanta falcons ' training facility, just hours before hitting the team's practice field for the. Web we have written a few articles on owners drawings, in particular dealing with interest charges and tax. Web the. Web an owner's draw is money taken out of a business for personal use. Most types of businesses permit draws, but you should consider whether and when to take one. The owner's draw is essential for several reasons. Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. Owner’s draws. This is recorded on their balance sheet as a debit to checking (an asset) and a credit to their owner's initial equity account. Typically, owners will use this method for paying themselves instead of taking a regular salary, although an owner's draw can also be taken in addition to receiving a regular salary from the business. Sat in his room. There are no rules regarding the intervals of an owner's draw. Most types of businesses permit draws, but you should consider whether and when to take one. Many small business owners compensate themselves using a draw rather than paying themselves a salary. Owner’s draws are usually taken from your owner’s equity account. Web an owner's draw is money taken out. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. Web an owner’s draw refers to an owner taking funds out of the business for personal use. Web head coach mike tomlin, general manager omar khan and team owner art rooney. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a partnership, can take money from the company if needed. Web also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Web an owner's draw is money. Pros and cons of an. This is a contra equity account that is paired with and offsets the owner's capital account. Owner’s draws are usually taken from your owner’s equity account. Web the most common way to take an owner’s draw is by writing a check that transfers cash from your business account to your personal account. Web an owner’s. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. Web transfer cash from a small business to the owner without raising personal income taxes or affecting the business's net income with owner drawings. In other words, it is a distribution of earnings to the owner (s) of a business, as opposed to a salary or wages paid to employees. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. This is a contra equity account that is paired with and offsets the owner's capital account. It might seem like raiding the company for. Salary is a regular, fixed payment like an employee would receive. Business owners might use a draw for compensation versus paying themselves a salary. It's considered an owner's draw if you transfer money from your business bank account to your personal account and use that money for personal expenses. For certain business structures, there is no restriction on owners to withdraw money from the business as and when needed. Consider your profits, business structure, and business growth when deciding how to pay yourself as a business owner. This is recorded on their balance sheet as a debit to checking (an asset) and a credit to their owner's initial equity account. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a partnership, can take money from the company if needed. Patty could withdraw profits from her business or take out funds that she previously contributed to her company. Sat in his room thursday evening at the atlanta falcons ' training facility, just hours before hitting the team's practice field for the.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Custom Pet and Owner Portrait Dog Cartoon Cute Illustration Etsy

Owners Draw

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owner Drawing at GetDrawings Free download

Single continuous line drawing of two young happy business owner

What Is an Owner's Draw? Definition, How to Record, & More

Custom Pet and Owner Portrait Dog Cartoon Cute Illustration Drawing

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)

Owner's Draw What Is It?

Dog and Owner Portrait Custom Line Drawing From Photo Line Etsy UK

Many Small Business Owners Compensate Themselves Using A Draw Rather Than Paying Themselves A Salary.

Whatever Funds Are Available After You Pay Your Bills Are Yours For Personal Use Or To Put Back Into The.

When A Sole Proprietor Starts Their Business, They Often Deposit Their Own Money Into A Checking Account.

These Draws Can Be In The Form Of Cash Or Other Assets, Such As Bonds.

Related Post: