Retirement Drawing

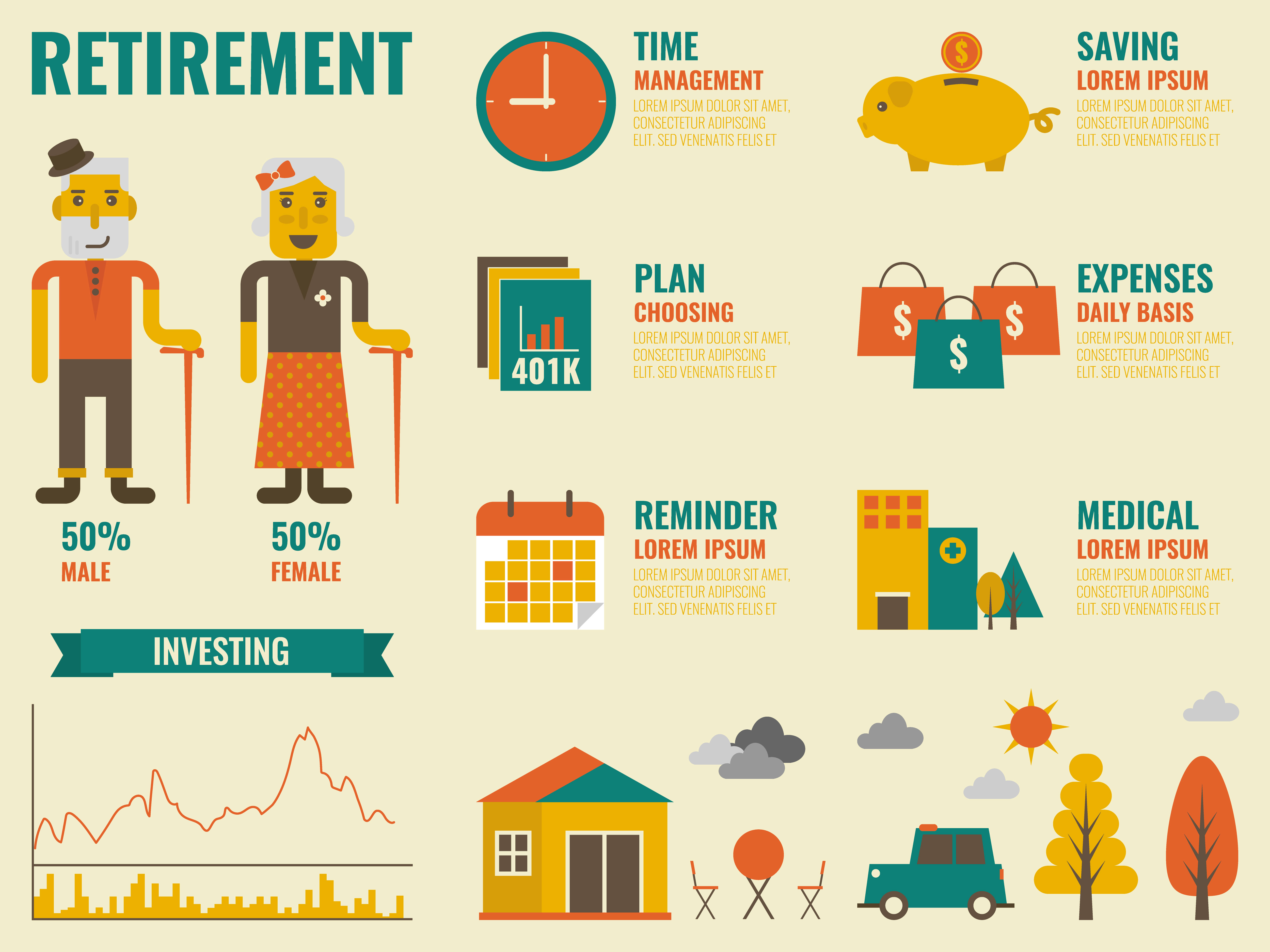

Retirement Drawing - Web social security and early retirement at age 55: This page will guide you through the process of applying for retirement benefits when you’re ready to take that step. Enter your current age (#): Determine what you need to withdraw. Why would they do that? Web retirement planning is the process of determining retirement income goals and the actions and decisions necessary to achieve those goals. Check the status of your retirement plan by answering six simple questions. How much can you spend in retirement? Most people spend years saving for retirement. You can get social security retirement benefits and work at the same time. Web the cola for 2024 was 3.2%, meaning beneficiaries received a 3.2% boost in benefits starting in january. Why would they do that? Web if you are at least 66 years and 2 months old, the top threshold currently in effect for social security's full retirement age, the answer is no. Use the retirement withdrawal calculator to find out how. Web the listing broker’s offer of compensation is made only to participants of the mls where the listing is filed. Use the retirement withdrawal calculator to find out how long your money will last or. What are required minimum distributions? Web in fact, according to the social security administration (ssa), 47% of current retirees have their retirement base as age. Web the most commonly cited strategy is the 4% rule, suggesting that retirees withdraw 4% of their retirement portfolio in the first year, adjusting annually for inflation to ensure the fund lasts at. What happens if i work and get social security retirement benefits? Web in fact, according to the social security administration (ssa), 47% of current retirees have their. Enter the annual interest rate you expect to earn (%): Web use this calculator to explore how you could save more for retirement based on different time horizons, asset allocations and changes in tax rates. Web in fact, according to the social security administration (ssa), 47% of current retirees have their retirement base as age 62 to 64, meaning they. Web the ultimate retirement planning guide for 2022. Web use the social security full retirement age calculator to find out when you are eligible for unreduced retirement benefits based on your birth year. What happens if i work and get social security retirement benefits? It involves identifying sources of income, estimating. Web the default is 67, although you can begin. When it comes to social security and when you should start receiving it, the answer is clear: Most people spend years saving for retirement. Web published 17 january 2024. Enter your current age (#): This adjustment aims to help social security keep up with inflation over time. In order to set your withdrawal plan you first need to know how much you’ll need and want. You can get social security retirement benefits and work at the same time. Leverage the social security retirement age chart if you are not yet full retirement age to know when you should start drawing benefits. Web the default is 67, although. The fidelity retirement score sm: An important part of enjoying a fruitful. Enter the age you plan to retire at (#): Enter the number of years you would like to make the monthly withdrawals (#): How much can you spend in retirement? This calculator will help you with retirement planning and provide you with an estimate on your future. Web starting your social security retirement benefits is a major step on your retirement journey. Web retirement planning is the process of determining retirement income goals and the actions and decisions necessary to achieve those goals. But if you are working and are. Then, when the time comes to begin spending their savings, they have no strategy in place. In order to set your withdrawal plan you first need to know how much you’ll need and want. Web philadelphia eagles star center jason kelce said that he’ll make an official announcement about the status of his nfl career “in the future.” “i’m not. Web your age determines what actions you may take in your retirement plan. Enter the number of years you would like to make the monthly withdrawals (#): Web the listing broker’s offer of compensation is made only to participants of the mls where the listing is filed. Updated tue, sep 20 2022. Web retirement planning is the process of determining retirement income goals and the actions and decisions necessary to achieve those goals. Determine what you need to withdraw. Web published 17 january 2024. What are required minimum distributions? Web the most commonly cited strategy is the 4% rule, suggesting that retirees withdraw 4% of their retirement portfolio in the first year, adjusting annually for inflation to ensure the fund lasts at. You work hard for decades and save diligently for retirement, but unfortunately, you can’t retire from paying taxes. An illustration of a heart shape donate to the archive an illustration of a magnifying glass. Web compare investments and savings accounts. Enter your current age (#): Many retirement experts encourage people. Are you saving enough for retirement? Full retirement and age 62 benefit by year of birthhappy retirement People Illustrations Creative Market

Happy retirement Holy Mackerel

Happy retirement. Hand drawn lettering calligraphy quote. Banner about

Printable Happy Retirement Customize and Print

Retirement 545337 Vector Art at Vecteezy

Happy Retirement stock vector. Illustration of woman 62252255

Free Printable Happy Retirement Printable Form, Templates and Letter

Free Vector Hand drawn retirement greeting card

A vector illustration of happy senior retirement at the beach Stock

Happy Retirement Stock Illustrations 14,573 Happy Retirement Stock

Web Social Security And Early Retirement At Age 55:

In Order To Set Your Withdrawal Plan You First Need To Know How Much You’ll Need And Want.

Why Would They Do That?

The Fidelity Retirement Score Sm:

Related Post: